Automated Visual Line Inspections

Risk Reduction Category

Technology Description

Utilities commonly employ uncrewed aircraft systems (UAS) to capture imagery, LiDAR, and other data of important assets for monitoring vegetation encroachment and asset conditions. There are at least two advantages to using UAS to perform this work. Depending on terrain and access, an aerial inspection can be done faster versus visual inspections on foot, even with line-of-sight restrictions for drone operation. Additionally, aerial imagery provides a beneficial visual perspective for inspections of overhead assets.

The sheer physical size of the transmission and distribution infrastructure makes inspecting those assets challenging. Utilities usually use a combination of ground-based patrols and manned aircraft flights for routine and emergency response inspections. These traditional approaches are costly, time consuming, and require human involvement. UAS have the potential to reinvent the existing processes, as well as open the door for an automated future. A few of these use cases are listed below.

Transmission Structure and Line Inspection

Utility maintenance best practices require routine detailed inspections of transmission structures and the conductor. The traditional methods for these inspections require helicopters, bucket trucks, or climbers. UAS can supplement or replace these methods in certain scenarios. Some utilities are using UAS for this application. Previous EPRI research has shown there is opportunity for efficiency gains of UAS over bucket trucks or climbing methods inspections. Additionally, EPRI research has shown that UAS can perform high quality inspections due to their small size, and ease of positioning around structures. EPRI expects that with new automation schemes and a relaxation of regulations, UAS will eventually become the preferred method of performing routine overhead asset inspections for utilities.

Transmission Vegetation Inspections

Utilities routinely perform inspections on transmission to reduce vegetation encroachment risks. Utilities use a mix of planes, helicopters, and ground patrols to perform visual inspections, LiDAR, and sometimes photogrammetry. UAS may be used to supplement or replace these methods in certain scenarios. However, for most of the traditional inspections, the costs are much lower than what can be achieved with a UAS primaily because of line-of-sight restrictions on UAS. EPRI expects UAS to replace most of these traditional methods when regulations allow for operations beyond visual line-of-sight.

Transmission Right-of-Way Patrols

Along with vegetation inspections, utilities sometimes also perform right-of-way patrols with fixed-wing airplanes. These inspections are different than the detailed inspections of the transmission structure and line. Instead, these patrols are fast “fly-bys” that look for large transmission risks. These include leaning structures, right-of-way erosion, shooting houses, etc. UAS can certainly capture the same type of data. However, the costs per mile for fixed-wing right-of-way patrols is very low for this use case. The utility industry expect that these inspections won’t be replaced with a UAS until beyond visual line-of-sight operations are allowed.

Transmission LiDAR Surveys

Utilities can use aerial LiDAR for a number of applications. Vegetation growth inspections is one, but transmission construction as-built engineering surveys is another. UAS LiDAR payloads are commercially available. Furthermore, some utilities are using UAS LiDAR surveys for small jobs. However, similar to the vegetation analysis, the inefficiencies of relocating several times due to line-of-sight requirements push the business case to favoring traditional aerial LiDAR surveying methods.

Technical Readiness (Commercial Availability)

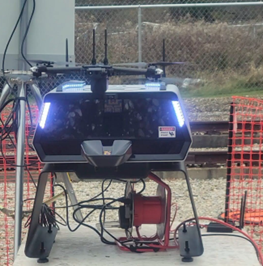

There are two main areas for high-value automation: autonomous inspection and autonomous image processing. Autonomous inspection refers to the act of flying around a structure and capturing data. Automated image processing refers to automatically processing images to flag potential abnormal situations. Several vendors are developing automated flight and image processing systems. What is envisioned is a periodically self-deploying UAS, located in a sheltered charging station, that would fly a programmed (or self-guided) route around utility assets. Imagery collected by the UAS could be uploaded to a cloud service or processed locally. Machine learning would analyze the imagery, detect anomalies, and send alerts upon detection of these anomalies.

Using today’s technology, UAS are already capable of flying programmed routes, and while machine learning has been demonstrated to be effective at detecting anomalies in imagery. The effectiveness of combining these technologies for the specific purpose of utility asset inspections is itself an emerging use case.

One of the immediate challenges today involves FAA regulations against flying a drone beyond line of sight of an operator. Gradually, the FAA is loosening some of these restrictions and exceptions are being granted within specified conditions. Another challenge with the use case has to do with the ability to capture useful imagery [1]. Although seemingly straightforward, image capture is highly dependent on precise positioning of the UAS for the best view of an asset. Also, lighting, truncation, and obscuring of the asset of interest can be factors.

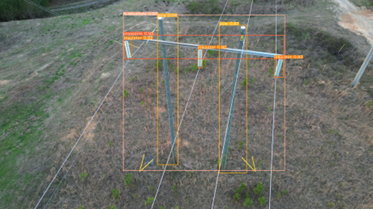

Anomaly detection in imagery is accomplished by first identifying asset classes in the image against a catalog of known asset classes. Once an asset class is identified within an image, the AI marks the asset with a bounding rectangle. The AI can then search within that bounding rectangle for defects associated with the class. EPRI has conducted research toward training AI models through capture of thousands of images, defining object recognition parameters for complex physical structures, and making the imagery publicly available for AI researchers [1].

Figure credit [1]

The following list of manufacturers is the product of an Internet search using a general description of the technology as the search term. Sometimes more than one variation on the search term is used. The objective is to identify the most demonstration-ready products available in the category. Toward assessing demonstration readiness, the manufacturer websites typically provide useful information such as writeups of successful use cases or field demonstrations, number of deployments, or other indicators. Where lack of information exists online, further inquiry is made by phone. Generally, one to three frontrunners emerge as being most ready for a field demonstration. Preference is given to manufacturers who sell to the United States, or, if emerging technology, those who have participated in US-based field demonstrations.

Drone Docks

- Skydio: https://www.skydio.com/

- DJI: https://enterprise.dji.com/dock

- Icaros

- Hextronics: https://www.hextronics.tech/

- Autel Robotics: https://www.autelrobotics.com/productdetail/evo-nest/

- Strix Drones: https://www.strixdrones.com/

- Airobotics: https://www.airoboticsdrones.com/optimus/

AI Image Processing of Utility Assets

- Brains4Drones: https://brains4drones.com/docs/Gimbal-plus-product-sheet.pdf

- Optelos: https://optelos.com/power-utilities/

End-to-End Solutions

- Percepto: https://percepto.co/aim/

- Volatus: https://volatusaerospace.com/aerieport-drone-nesting-station/

Implementations/Deployments

SDG&E is experimenting (2018) with the use of Unmanned Aircraft Systems (UAS) to perform periodic inspections of its distribution facilities to better ascertain system conditions. One expert cited an example of a UAS inspection performed in preparation of a Red Flag Warning. The aerial inspection involved 20 poles located in a canyon with extremely limited access and dense vegetation. The inspection took 3 hours to complete, as compared to a field crew estimate of two days to perform the same inspection by foot. The inspection revealed enough damaged equipment to lead to a decision to de-energize the line after load was transferred to other circuits. The local district immediately began work orders to fix the largest equipment concerns identified, included a leaning pole, cracked insulators and severely hollowed cross arms from wood rot. [2]

Duke Energy, in partnership with EPRI, is capturing imagery of their overhead assets and is actively looking for ways to leverage AI to make best use of this imagery across their service territories in six states [3]. Their goal is to convert processed automated imagery collections into work orders. They are looking a pre-planned routes in order to identify and collect the “right” imagery.

References

[1] Artificial Intelligence for Transmission Images: An Object Detection Case Study. EPRI, Palo Alto, CA: 2023. 3002028093.

[2] Reliability and Resiliency Practices: Practices for Serving Critical Infrastructure and Events. EPRI, Palo Alto, CA: 2018. 3002012880.

[3] “Accelerating Transmission and Distribution (T&D) Inspections with Drones and Artificial Intelligence” EPRI, Palo Alto, CA: October 6, 2021. https://www.youtube.com/watch?v=ZXNrew5fieo