This the multi-page printable view of this section. Click here to print.

Wildfire Mitigation Technologies Database

- 1: Asset Condition Monitoring

- 1.1: Aerial Asset Inspections - E-Field Sensing

- 1.2: Automated Visual Line Inspections

- 1.3: Charred Pole Integrity

- 1.4: Line Sensing Technology

- 1.5: Line Splice Sensing

- 1.6: Asset Inspections by Multispectral Imagery

- 2: Environmental Monitoring

- 2.1: Gas-Sensing Remote Smoke Detectors

- 2.1.1: Dryad

- 2.1.2: Torch

- 2.1.3: Milesight

- 2.1.4: Libelium

- 2.1.5: Hayden Data Systems

- 2.2: LiDAR - Light Detection and Ranging

- 2.3: Micro Weather Stations

- 2.4: Vegetation Condition Assesssment by Multispectral Imagery

- 2.5: Smoke Detection Cameras

- 2.6: Synthetic Aperture Radar (SAR) from Satellite Imagery

- 3: Fault Count and Frequency Reduction

- 3.1: Covered Overhead Conductors

- 3.2: Hybrid Undergrounding

- 3.3: Optimized Construction Practices

- 3.4: Strategic Undergrounding

- 4: Fault Energy Reduction

- 4.1: Fault Energy Limiting Fuses

- 4.2: Non-Expulsion Fuse Designs

- 4.3: Powerline Carrier (PLC) Signalling

- 4.4: Protective Device Communication

- 4.5: Public Safety Power Shutoff

- 4.6: Pulse Reclosing

- 4.7: Reclose Blocking - Manual

- 4.8: Reclose Blocking Automated

- 4.9: Fault Energy Limiting – Rapid Earth Fault Current Limiter (REFCL)

- 5: Fire Protective Materials

- 5.1: Fire Inhibiting Sprays

- 5.2: Fire Protective Material for Wood Poles

- 5.3: Fire-Resistant Fencing

- 5.4: Flame-inhibiting Coverings

- 5.5: Smoke/Soot Inhibitors

- 5.6: Vegetation Clearing and Brushing

- 6: Grid Monitoring

- 6.1: Falling Conductor Protection

- 6.2: Faulted Circuit Indicators

- 6.3: High-Impedance Fault Detection

- 6.4: IND.T EFD Device

- 6.5: Distribution Fault Anticipator (DFA)

- 6.6: Smart Meters (Advanced Metering Infrastructure or AMI)

- 6.7: Substation PQ and RFI

- 6.8: Substation 60-Hz PQ Monitors

- 7: Modeling and Simulation

1 - Asset Condition Monitoring

1.1 - Aerial Asset Inspections - E-Field Sensing

Risk Reduction Category

Technology Description

Today, utilities commonly use imagery from unmanned aerial systems (UAS) to improve their vantage point when inspecting overhead assets. As of 2023, most UAS used in this way are manually operated, however, as technology improves and regulations are more favorable, automation is increasingly possible. As an example, to supplement manual flight control, UAS are now capable of identifying poles and flying a prescribed path around each pole in order to capture images. While imagery alone is often sufficient for asset inspections, the success of an inspection is dependent on the quality of imagery, which is subject to camera positioning, glare from sunlight, shadowing, and other interference.

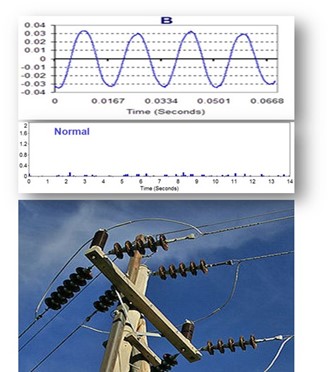

Supplemental information from electric field sensors could improve visual inspections. The idea of an electric field sensor mounted to UAS is an emerging approach for inspecting assets to detect pre-failure conditions. It would be used as a supplement to visual imagery rather than a replacement. As an enhancement to visual inspections, an e-field sensor on the same UAS can improve anomaly detection by capturing arcing signatures. The utility can use this additional layer of intelligence to identify whether an asset needs to be replaced or put on a watch list. In the figures below, compare the normal condition (left) to the abnormal condition (right) where visual inspection alone is unable to discern this anomaly.

Technical Readiness (Commercial Availability)

Electric field sensing is a mature technology and has a very wide range of applications. Additionally, mounting e-field sensors to an unmanned aerial system is also used for a variety of applications. What is innovative is the idea of identifying unique signatures that could warn of insipient failures on utility assets. To deploy such a device, important hardware and software requirements for this application are:

- Signal Analyses, either real-time or post-processed

- Waveform anomaly detection

- Spectrum analysis

- Geo-locating

- Imagery from camera

- Local data storage or streaming to ground support

Implementations/Deployments

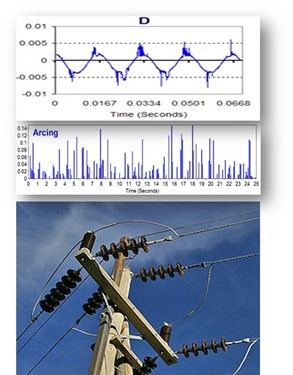

As an emerging application, EPRI is not aware of any commercial vendors innovating in this space. However, in 2019, EPRI developed US Patent 10,501,181 B1 for “Method and Apparatus for Aerial Scanning and Detection of Contact Voltages and Distinguishing Between Normal and Abnormal Electric Fields.” [1] This technology has not yet been field tested outside of proof-of-concept tests in a controlled environment. Snapshots from an experimental trial are shown below, including the following real-time data:

- Geolocation (left)

- Visual imagery (left)

- Waveform capture and streaming (top right)

- Spectrum analysis (bottom right)

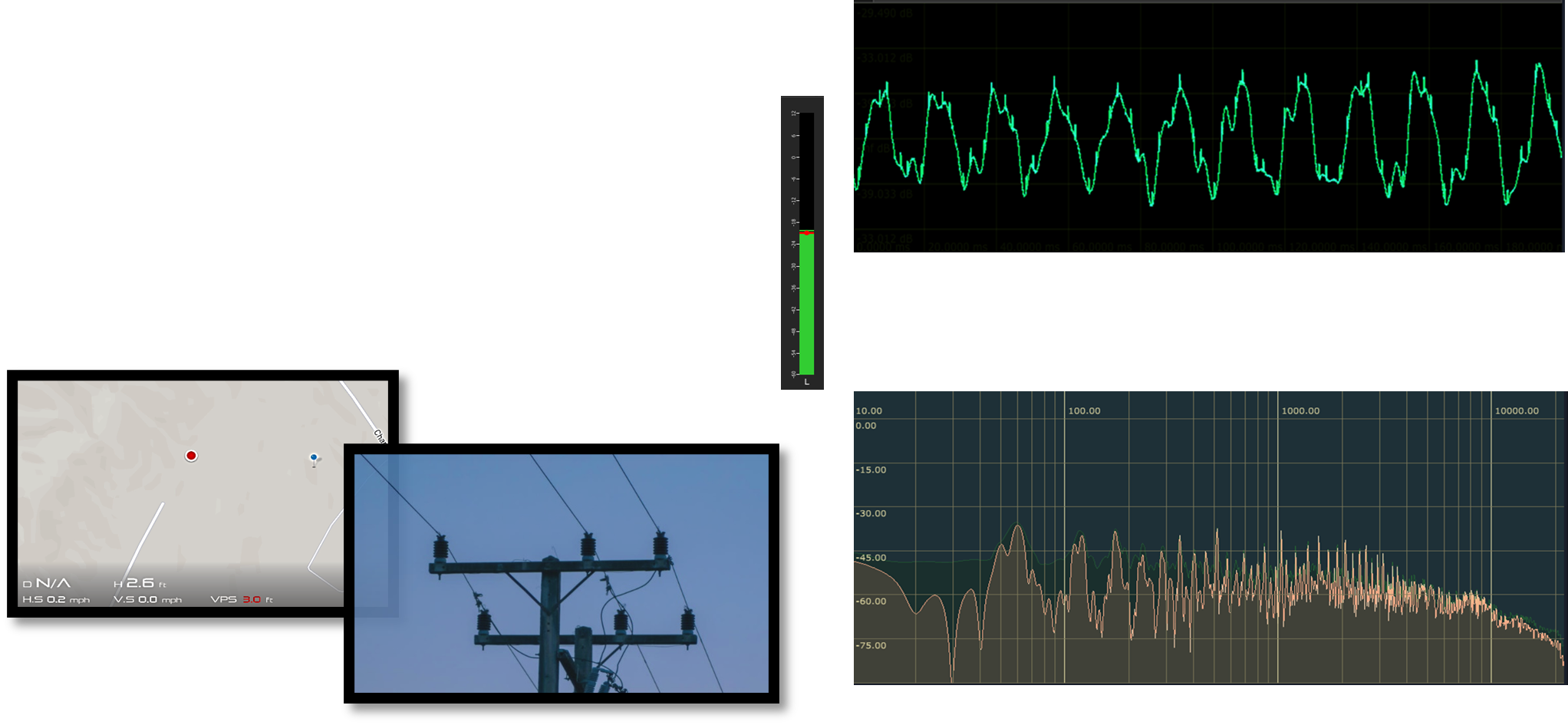

Another EPRI innovation closely related to the topic is what EPRI calls their Portable Radiated Emissions Measurement System, version 2 (PREMS II). EPRI has created a mobile system built on a roboticized platform to enable efficient, accurate, and repeatable electric field measurements over broad geographical areas. See figure below. The tool is designed to quickly and efficiently pinpoint sources of radiated emissions. With a simple web-based interface, PREMS II connects to a suite of available sensors to allow for expedient capturing of GPS coordinated sensor data. As proven in two use cases in 2020 using prototype configurations, the PREMS II system helps the user to observe electric field and frequency spectrum through heat maps overlaid on satellite imagery. This technology can enable utilities to accelerate the measurement and detection of the sources of radiated emissions issues, thereby expediting mitigation and promoting compatibility between the electrical grid, end-use customers, and a myriad of related systems. This system offers a ground-based, versus aerial platform on which to build additional intelligence to potentially detect insipient fault signatures from failing overhead assets.

Innovations as of Mid 2023

As a related technology, Manifold Robotics, with financial support from New York State Energy Research and Development Authority (NYSERDA) developed an e-field-guided drone that uses electric fields from powerlines to navigate along overhead assets. [2] This technology is used to aid the navigation and positioning of the drone in order to improve the capture of visual imagery. While the usage of e-field data differs in this application, it offers a hardware platform for further developing e-field signature recognition.

Potential Enrichment Work Opportunity

References

[1] https://image-ppubs.uspto.gov/dirsearch-public/print/downloadPdf/10501181

1.2 - Automated Visual Line Inspections

Risk Reduction Category

Technology Description

Utilities commonly employ uncrewed aircraft systems (UAS) to capture imagery, LiDAR, and other data of important assets for monitoring vegetation encroachment and asset conditions. There are at least two advantages to using UAS to perform this work. Depending on terrain and access, an aerial inspection can be done faster versus visual inspections on foot, even with line-of-sight restrictions for drone operation. Additionally, aerial imagery provides a beneficial visual perspective for inspections of overhead assets.

The sheer physical size of the transmission and distribution infrastructure makes inspecting those assets challenging. Utilities usually use a combination of ground-based patrols and manned aircraft flights for routine and emergency response inspections. These traditional approaches are costly, time consuming, and require human involvement. UAS have the potential to reinvent the existing processes, as well as open the door for an automated future. A few of these use cases are listed below.

Transmission Structure and Line Inspection

Utility maintenance best practices require routine detailed inspections of transmission structures and the conductor. The traditional methods for these inspections require helicopters, bucket trucks, or climbers. UAS can supplement or replace these methods in certain scenarios. Some utilities are using UAS for this application. Previous EPRI research has shown there is opportunity for efficiency gains of UAS over bucket trucks or climbing methods inspections. Additionally, EPRI research has shown that UAS can perform high quality inspections due to their small size, and ease of positioning around structures. EPRI expects that with new automation schemes and a relaxation of regulations, UAS will eventually become the preferred method of performing routine overhead asset inspections for utilities.

Transmission Vegetation Inspections

Utilities routinely perform inspections on transmission to reduce vegetation encroachment risks. Utilities use a mix of planes, helicopters, and ground patrols to perform visual inspections, LiDAR, and sometimes photogrammetry. UAS may be used to supplement or replace these methods in certain scenarios. However, for most of the traditional inspections, the costs are much lower than what can be achieved with a UAS primaily because of line-of-sight restrictions on UAS. EPRI expects UAS to replace most of these traditional methods when regulations allow for operations beyond visual line-of-sight.

Transmission Right-of-Way Patrols

Along with vegetation inspections, utilities sometimes also perform right-of-way patrols with fixed-wing airplanes. These inspections are different than the detailed inspections of the transmission structure and line. Instead, these patrols are fast “fly-bys” that look for large transmission risks. These include leaning structures, right-of-way erosion, shooting houses, etc. UAS can certainly capture the same type of data. However, the costs per mile for fixed-wing right-of-way patrols is very low for this use case. The utility industry expect that these inspections won’t be replaced with a UAS until beyond visual line-of-sight operations are allowed.

Transmission LiDAR Surveys

Utilities can use aerial LiDAR for a number of applications. Vegetation growth inspections is one, but transmission construction as-built engineering surveys is another. UAS LiDAR payloads are commercially available. Furthermore, some utilities are using UAS LiDAR surveys for small jobs. However, similar to the vegetation analysis, the inefficiencies of relocating several times due to line-of-sight requirements push the business case to favoring traditional aerial LiDAR surveying methods.

Technical Readiness (Commercial Availability)

There are two main areas for high-value automation: autonomous inspection and autonomous image processing. Autonomous inspection refers to the act of flying around a structure and capturing data. Automated image processing refers to automatically processing images to flag potential abnormal situations. Several vendors are developing automated flight and image processing systems. What is envisioned is a periodically self-deploying UAS, located in a sheltered charging station, that would fly a programmed (or self-guided) route around utility assets. Imagery collected by the UAS could be uploaded to a cloud service or processed locally. Machine learning would analyze the imagery, detect anomalies, and send alerts upon detection of these anomalies.

Using today’s technology, UAS are already capable of flying programmed routes, and while machine learning has been demonstrated to be effective at detecting anomalies in imagery. The effectiveness of combining these technologies for the specific purpose of utility asset inspections is itself an emerging use case.

One of the immediate challenges today involves FAA regulations against flying a drone beyond line of sight of an operator. Gradually, the FAA is loosening some of these restrictions and exceptions are being granted within specified conditions. Another challenge with the use case has to do with the ability to capture useful imagery [1]. Although seemingly straightforward, image capture is highly dependent on precise positioning of the UAS for the best view of an asset. Also, lighting, truncation, and obscuring of the asset of interest can be factors.

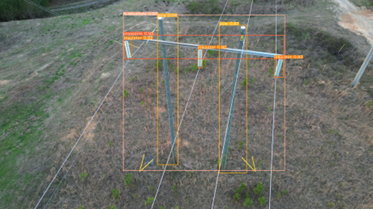

Anomaly detection in imagery is accomplished by first identifying asset classes in the image against a catalog of known asset classes. Once an asset class is identified within an image, the AI marks the asset with a bounding rectangle. The AI can then search within that bounding rectangle for defects associated with the class. EPRI has conducted research toward training AI models through capture of thousands of images, defining object recognition parameters for complex physical structures, and making the imagery publicly available for AI researchers [1].

Figure credit [1]

The following list of manufacturers is the product of an Internet search using a general description of the technology as the search term. Sometimes more than one variation on the search term is used. The objective is to identify the most demonstration-ready products available in the category. Toward assessing demonstration readiness, the manufacturer websites typically provide useful information such as writeups of successful use cases or field demonstrations, number of deployments, or other indicators. Where lack of information exists online, further inquiry is made by phone. Generally, one to three frontrunners emerge as being most ready for a field demonstration. Preference is given to manufacturers who sell to the United States, or, if emerging technology, those who have participated in US-based field demonstrations.

Drone Docks

Skydio https://www.skydio.com/

DJI https://enterprise.dji.com/dock

Icaros https://icarosgeospatial.com/sams/

Hextronics

https://www.hextronics.tech/the-atlas

https://www.hextronics.tech/the-universal

Autel Robotics https://www.autelrobotics.com/productdetail/evo-nest/

Strix Drones https://www.strixdrones.com/

Airobotics https://www.airoboticsdrones.com/optimus/

AI Image Processing of Utility Assets

Brains4Drones https://brains4drones.com/docs/Gimbal-plus-product-sheet.pdf

Optelos https://optelos.com/power-utilities/

End-to-End Solutions

Percepto

https://percepto.co/drone-in-a-box/percepto-base/

Volatus https://volatusaerospace.com/aerieport-drone-nesting-station/

Implementations/Deployments

SDG&E is experimenting (2018) with the use of Unmanned Aircraft Systems (UAS) to perform periodic inspections of its distribution facilities to better ascertain system conditions. One expert cited an example of a UAS inspection performed in preparation of a Red Flag Warning. The aerial inspection involved 20 poles located in a canyon with extremely limited access and dense vegetation. The inspection took 3 hours to complete, as compared to a field crew estimate of two days to perform the same inspection by foot. The inspection revealed enough damaged equipment to lead to a decision to de-energize the line after load was transferred to other circuits. The local district immediately began work orders to fix the largest equipment concerns identified, included a leaning pole, cracked insulators and severely hollowed cross arms from wood rot. [2]

Duke Energy, in partnership with EPRI, is capturing imagery of their overhead assets and is actively looking for ways to leverage AI to make best use of this imagery across their service territories in six states [3]. Their goal is to convert processed automated imagery collections into work orders. They are looking a pre-planned routes in order to identify and collect the “right” imagery.

Innovations as of Mid 2023

Potential Enrichment Work Opportunity

References

[1] Artificial Intelligence for Transmission Images: An Object Detection Case Study. EPRI, Palo Alto, CA: 2023. 3002028093.

[2] Reliability and Resiliency Practices: Practices for Serving Critical Infrastructure and Events. EPRI, Palo Alto, CA: 2018. 3002012880.

[3] “Accelerating Transmission and Distribution (T&D) Inspections with Drones and Artificial Intelligence” EPRI, Palo Alto, CA: October 6, 2021. https://www.youtube.com/watch?v=ZXNrew5fieo

1.3 - Charred Pole Integrity

Risk Reduction Category

Technology Description

The degree of damage imposed on utility assets by a wildfire depends upon the temperature of the fire and duration of its presence. Particularly vulnerable to wildfires are wooden poles and crossarms. In 2022, testing of wooden cross arms by the Western Fire Center, Inc. determined that the wooden crossarms retained specified strength (300 pounds at each end of the crossarm) for at least twenty minutes under a combination of radiant heat and flames. For exposure to flames alone, the crossarms retained strength for at least 30 minutes. By comparison, fiberglass crossarms collapsed within around seven minutes.[2]

While crossarms and poles may survive a fire, structural damage may not be evident and the long-term effects unknown as well. What is important to know is the degree of damage that is caused so that a decision can be made whether to leave the asset in service, inspect it again after a time, or replace it.

The United States Department of Agriculture, the Forest Service, Forest Products Laboratory, the Bureau of Land Management (Idaho, Boise District), and university collaborators published a report describing two strategies that may expedite such inspections and identify poles that are structurally unsound due to decay and those damaged during a wildfire.[3] Yet, many of these test devices may indicate weakness at the tested location only—requiring a succession of test points to provide an accurate assessment of the health of the pole.

EPRI has published several reports concerning utility pole tests over the last ten to fifteen years examining various methods of testing power poles for rot and insect damage. One such report examined fifteen non- destructive testing (NDT) methods of examining power poles. [7] Several technologies are compared in an EPRI report: Evaluation of Pole Inspection Technologies. [11] These include traditional methods such as:

- Sounding – Decaying wood sounds different than healthy wood when struck with a hammer. Experienced field workers can generally hear the difference.

- Boring – Drilling into the pole allows an inspector to locate and judge the approximate size of internal voids in the pole cross section.

- Excavation – Digging around the pole base and removing the soil allows inspectors to visually inspect and sound a below-ground portion of the pole.

- Circumference measurements – Measuring the pole’s thickness allows the inspector to quantify exterior cross-section loss of the pole.

- Visual inspection of the pole exterior – Some defects such as bends, burns, and rot can be visually identified.

- Some poles were tested to destruction to measure their remaining pole strength

The above methods require significant skill (pole sounding might require experience with 5,000 poles).

More modern methods include:

- Resistance drilling – This method is similar to boring but measures the physical resistance (torque required) to drill into the pole as a proxy for wood health.

- Sonic and ultrasonic – This method uses sound waves to measure the pole vibrations. It’s similar to sounding but leverages machines to perform the listening.

- X-radiographic tools – This method uses X-rays to produce images that can be used to characterize internal portions of a pole cross section.

- Gamma-ray densiometry – This method uses gamma rays to identify degraded areas in wood poles.

- Vibration analysis – This method is based on the understanding that the vibrational characteristics of a pole depend on its material properties, including the health, i.e., strength and stiffness, of the wood.

The above tend to be complex to use, costly, and lacking in field trials.

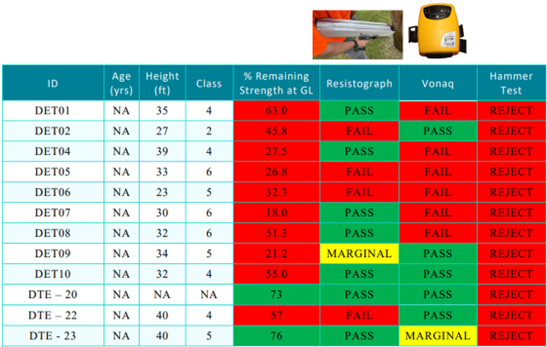

The EPRI report used several of the above traditional and more modern NDT methods—but not always on the same pole. An excerpt from the report shows a comparison of results (12 of 42) for the Resistograph, the Vonaq, and the traditional hammer test (not Thor) where they were tested on the same pole. The percent remaining strength was from destructive testing on the poles afterward.

Testing overall observed that the conservative and traditional sonic test tended to reject poles that might still be functional. The Resistograph identified decay at the groundline (where it was employed) but could not identify weakness further up the pole (such as charring); thus, a high number of false positives resulted. Of the poles tested by the Vonaq, roughly one third were “passed” where they might have been marginal or rejected—possibly due to close-by vegetation and/or truss-work above the groundline.

While many hours of training were required for the traditional methods, the two newer methods above required only a few hours of training and hands-on experience.

Of the above modern methods, the sonic methods may be most applicable to charred poles if only due to the likely change in cross-sectional area over the length of the pole which would affect pole strength and could be assessed using the Vonaq or Thor Pole tester. However, an electronic reference history of poles and corresponding sonic tests may be necessary to have an accurate assessment of the pole-strength degradation due to the wildfire.

Technical Readiness (Commercial Availability)

Professor Bruce Allison, working closely with the University of Wisconsin and the USDA Forest Products Laboratory and the University of Wisconsin, developed a stress-wave tool called Tree Check.[4] While initially intended for trees, this method can work for utility poles.

Another method involves using a small drill to assess the resistance of the wood to the drilling process. This resistance is much less for decayed wood than for uncompromised wood.[3] One version of this tool is shown below.

The same company producing the drill tool above also produces the IML Micro Hammer which measures the sound velocity in wood in response to hammer taps as illustrated below.

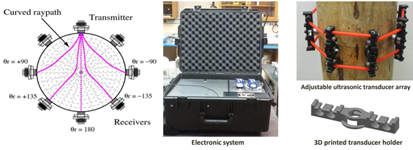

Another method developed for use with utility poles specifically involves using ultrasound. In 2009, Fernando Talavo wrote a thesis on using ultrasound to assess the structural integrity of utility poles [5] and went on to develop a tool for use in the field.[6] An ultrasound transmitter along with multiple receivers are used to assess the internal structure of the pole as shown below.

One apparently efficient development for utility pole testing might be the CXI PT5500 Pole Tester developed by Oxys Solutions (a Cinetix Group company). A probe is mounted on the pole at a measured height of 2 meters from the ground (for a charred pole, it may be necessary to scrape off a charred patch to get to uncharred wood at the 2-meter level). The person doing the test strikes the pole with a hammer. The probe analyzes the induced vibrations.

Another sonic method is the THOR Pole Tester by Groundline Engineering. This is a handheld device set—the specially designed hammer and sensor, and a tablet as shown below. One hand holds the sensor against the pole just above ground level while the hammer is struck on the opposite side of the pole (again, charred wood may have to be removed to expose solid wood). The tablet has the software that registers the sonic vibrations picked up by the sensor and may interact with the human tester to correct the sensor angle with the pole and/or the force of the hammer blow. Related software organizes all pole data with GIS coordinates which may be laid out on a map. [10] The charred wood on such a pole may have dampening effects. Many such tests (from the same pole tested previously or from a known good pole) may be required to gauge the results more accurately.

The following list of manufacturers is the product of an Internet search using a general description of the technology as the search term. Sometimes more than one variation on the search term is used. The objective is to identify the most demonstration-ready products available in the category. Toward assessing demonstration readiness, the manufacturer websites typically provide useful information such as writeups of successful use cases or field demonstrations, number of deployments, or other indicators. Where lack of information exists online, further inquiry is made by phone. Generally, one to three frontrunners emerge as being most ready for a field demonstration. Preference is given to manufacturers who sell to the United States, or, if emerging technology, those who have participated in US-based field demonstrations.

American Arborist – Tree Check

https://www.arborist.com/product/M130001-00/Tree-Check-Sonic-Wave-Decay-Detector.html

IML-RESI F-Series

https://www.iml-service.com/product/iml-resi-f-serie/

IML Microhammer

https://www.iml-service.com/product/iml-micro-hammer/

Vonaq Ltd - CXI PT5500 Pole Tester

https://www.etesters.com/catalog/ADBB546E-1422-08DF-AAC7-09285A92D511/vonaq-ltd/

THOR Pole Tester

Innovations as of Mid 2023

Potential Enrichment Work Opportunity

References

[1] https://woodpoles.org/Issues/Fire-Protection

[2] https://woodpoles.org/portals/2/documents/WFC_Crossarm_Test_Report.pdf

[3] https://www.fs.usda.gov/features/reducing-wildfires-through-better-utility-pole-inspections

[4] https://www.wxpr.org/natural-resources/2017-11-14/sound-waves-what-trees-can-tell-us

[5]https://uwspace.uwaterloo.ca/bitstream/handle/10012/4588/FT-Thesis.pdf;jsessionid=F9B80D282A954DA266F4504979E05144?sequence=1

[6] https://www.ndt.net/events/NDTCanada2016/app/content/Slides/12_Rodriguez-Roblero_Rev1.pdf

[7] A Review of Technologies for Detecting Decay or Insect Attack and Estimating Residual Wood Pole Properties. EPRI, Palo Alto, CA: 2020. 3002019302.

[8] https://www.youtube.com/watch?v=YQDaB_6bn3I

[9] https://www.etesters.com/catalog/ADBB546E-1422-08DF-AAC7-09285A92D511/vonaq-ltd/

[10] https://www.thorpoletest.com/

[11] Evaluation of Pole Inspection Technologies: 2023 Update. EPRI, Palo Alto, CA: 2023. 3002026858.

1.4 - Line Sensing Technology

Risk Reduction Category

Technology Description

Gridware is a tech startup out of California, having designed a unique, multi-detection monitoring tool for overhead lines that does not fit into any single functional category. The Gridscope is designed for mechanical and electrical anomaly detection, fault detection, fault location, and automatic categorization of the condition. For example, it can distinguish between vegetation and animal contact, as well as line breaks, pole tilt, insulator failure, conductor clash, and a variety of other conditions. Because of its fault locating capability and deployment density, crews are directed to the precise location of the issue, without scouting the line, and can arrive with the equipment and materials needed to address the specific issue.

The hardware is typically installed on every other pole, each unit having multiple monitoring variables such as vibration, spatial orientation, and electric field sensing. It is a completely wireless sensing unit in that it has no externally connected probes or taps. Additionally, it is powered from solar energy and communicates wirelessly in a mesh configuration and outbound to the Internet using cellular communications.

Monitoring of the hardware is currently provided as a service, where the vendor alerts subscribing utilities of detected conditions via telephone. Communication by telephone is viewed by the vendor as an air gap that avoids complications with IT and cyber security. Similarly, the inter-communicating hardware on the poles avoids these same issues by communicating independently of SCADA.

Technical Readiness (Commercial Availability)

Gridware https://www.gridware.io

The Gridware system is in commercial production with utilities in 6 states having deployed them: Washington, California, Utah, Colorado, New York, and Georgia.

Implementations/Deployments

ConEdison and EPRI participated in a pilot project with Gridware in 2023 [1]. In this pilot, ConEdison installed 100 sensors in storm-prone areas. During the demonstration period, they received 3 alerts which were verified by ConEdison as accurate with no false or inaccurate alerts.

EPRI Testing

EPRI conducted a series of blind tests involving several field applied scenarios shown below. The Gridscope device and software was able to accurately determine the event type and time for each test including whether the line was still energized on the ground or not. Several of the live test did not draw enough fault current to trip the 40T fuse nor the hotline tag enabled U4 curve of the upstream recloser.

Vegetation drop on de-energized three phase line

Energized 13.2/23 kV bare conductor break onto grass

Energized 13.2/23 kV & 7.2/12.47 kV bare conductor breaks into asphalt.

Innovations as of Mid 2023

Potential Enrichment Work Opportunity

Having the solar power and the communications at every pole or every other pole, an opportunity exists to add environmental sensing such as wind speed, humidity, and the like, in order to feed models for fire risk and spread.

References

1.5 - Line Splice Sensing

Risk Reduction Category

Technology Description

Line splices are ubiquitous, and while generally robust, sometimes, these splices may not have been constructed optimally such that the splice is weakened and/or may have greater impedance than specification. Thus, it may fail due to mechanical stress or the result of excess heating. One source indicated that many splice failures occur due to poor workmanship and/or due to corrosion after improperly applying a corrosion inhibitor. Should the splice physically fail, the broken conductor ends may fall upon dry, combustible vegetation and ignite a fire.

Inspection of electrical lines should occur with some regularity to identify weakened or overheated splices. A few tools that are commonly used today are described briefly:

- A micro-ohmmeter mounted to a hotstick can measure resistance across a splice while energized and inservice. [2]. Elevated resistance may indicate a failing splice.

- Infrared (IR) sensing may be used to detect heating of the splice. However, due to the reflective metallic surface (low emissivity) of many splices, infrared measurements can yield inaccurate results and therefore elevated surface temperatures may only be confirmed when the splice is close to failure.

- Thermal imaging cameras may be used to identify hotspots on the power line, on splices, or on other power line equipment, but are subject to the same emissivity concerns as infrared spot sensing.

- One company markets a device to mitigate faulty splices called the ClampStar, an electrical/mechanical shunt, that serves to brace and effectively bypass the weakened splice with no interruption of power as shown below [4].

Oak Ridge National Lab (ORNL) has developed an innovative sensor system using “smart” patches affixed to the exterior of a compression connector. The motivation for this development is to provide information about the structural integrity of the connector, where current inspection methods only warn of electrical impedance that is out of specification. In the ORNL work, a piezoelectric ceramic material (PZT) is integrated with the splice. This smart patch produces an electrical signal, that when processed, corresponds to a damage index. Laboratory tests included tensile strength and thermal cycling perturbations on the joint. The electrical signature is sensitive to variations in structural conditions so that utilities can correlate this analysis to the structural health of a connector, providing potential application in routine structural health monitoring. [5].

Technical Readiness (Commercial Availability)

The smart patch is a research and development effort by Oak Ridge National Laboratory. To the author’s knowledge, there has been no commercialization. This technology is subject to a US patent: J.-A. Wang, F. Ren, “Systems, methods and patches for monitoring a structural health of a connector in overhead transmission lines”, U.S. Patent, US 10,641,840 B2, May 5, 2020. [6].

Regarding tools that are commonly used by utilities today, the following list of manufacturers is the product of an Internet search using a general description of the technology as the search term. Sometimes more than one variation on the search term is used. The objective is to identify the most demonstration-ready products available in the category. Toward assessing demonstration readiness, the manufacturer websites typically provide useful information such as writeups of successful use cases or field demonstrations, number of deployments, or other indicators. Where lack of information exists online, further inquiry is made by phone. Generally, one to three frontrunners emerge as being most ready for a field demonstration. Preference is given to manufacturers who sell to the United States, or, if emerging technology, those who have participated in US-based field demonstrations.

Sensorlink – Ohmstik Plus

https://sensorlink.com/products/ohmstik

Teledyne FLIR (thermal imaging)

https://www.flir.com/instruments/utilities/electric-power-distribution/

HIKMICRO

https://www.hikmicrotech.com/en_us/

Fluke

https://www.fluke.com/en-us/products/thermal-cameras/product-selector

Implementations/Deployments

Innovations as of Mid 2023

Potential Enrichment Work Opportunity

References

[1] https://classicconnectors.com/downloads/understanding_automatic_splices.pdf

[2] https://classicconnectors.com/do-you-know-the-condition-of-your-splices/

[3] https://linestar.ca/specialty-items/clampstar-connector-corrector/clamp-star-flexible-frame/

[4] https://classicconnectors.com/products/

[5] Structural health monitoring of compression connectors for overhead transmission lines (spiedigitallibrary.org)

[6] DOE OE Wildfire Webinar Series - Sensing & Detection | Fire Testing Capabilities - YouTube

1.6 - Asset Inspections by Multispectral Imagery

Risk Reduction Category

Technology Description

Today, utilities commonly use imagery from unmanned aerial systems (UAS) to improve their vantage point when inspecting overhead assets. Depending on terrain and access, an aerial inspection can be done faster versus visual inspections on foot, even with current line-of-sight restrictions for drone operation. Additionally, aerial imagery provides a beneficial visual perspective for inspections of overhead assets.

The sheer physical size of the transmission and distribution infrastructure makes inspecting those assets challenging. Utilities usually use a combination of ground-based patrols and manned aircraft flights for routine and emergency response inspections. These traditional approaches are costly, time consuming, and require human involvement.

Multispectral cameras can extend the information gathered during aerial inspections, capturing information that is otherwise indetectable with standard visual (RGB) cameras. Most multi-spectral cameras capture RGB imagery along with imagery in the infrared and ultraviolet wavelengths. The extended bands can be captured at the same frame rates and resolutions as their visual counterparts, providing layers of imagery that can be analyzed by humans or AI.

- Visual (RGB) – captures bands detectable with the human eye (red, blue, and green)

- Infrared (IR)– detects heat signatures

- Ultraviolet (UV)– can reveal arcing, partial discharge, and flame

The addition of the IR band to traditional visual inspections increases the use cases to include: [1]

- Detecting issues with underground electrical distribution [2]

- Detecting water leakage from underground piping systems [4]

- Detecting methane emissions from natural gas infrastructure [3]

- Detecting evidence of corrosion from re-bar and cracking due ASR in containment structures

- Using TIR/NIR sensors to conduct nesting bird surveys and bat emergence counts

The addition of the UV band to traditional visual inspections increases the use cases to include: [1]

- Helping determine locations of power line corona discharge [3]

- Improving personnel safety by eliminating the need to access elevated locations.

- Reducing operating costs by identifying faults more quickly, which reduces time to inspect equipment.

Hyperspectral cameras operate in the same energy spectrum as multispectral cameras, but with many narrower bands. Hyperspectral cameras are not typically used today for aerial inspections because of cost and complexity, but the extra capability expands use cases, including: [1]

- Identifying deteriorating wood pole top conditions due to moisture ingress

- Detecting biological growth around plant coolant intakes and discharge areas

- Detecting evidence of corrosion from re-bar and cracking due to alkali-silica reaction (ASR) in containment structures

What is envisioned is a periodically self-deploying UAS, located in a sheltered charging station, that would fly a programmed (or self-guided) route around utility assets. Imagery collected by the UAS could be uploaded to a cloud service or processed locally. Machine learning would analyze the imagery, detect anomalies, and send alerts upon detection of these anomalies.

Technical Readiness (Commercial Availability)

Aerial inspections of utility asset via multispectral camera technology is a complex combination of state-of- the-art technologies:

- Automated UAS flight - As of 2023, most UAS deployed by utilities are manually operated, however, as technology improves automation is increasingly possible. A challenge with automated aerial asset inspections has to do with the ability to capture useful imagery [1]. Although seemingly straightforward, image capture is highly dependent on precise positioning of the UAS for the best view of an asset. Also, lighting, truncation, and obscuring of the asset of interest can be factors. This challenge is being addressed by improvements in navigation technology. For example UAS are now capable of identifying poles in flight and moving in a prescribed path around each pole in order to better capture visual attributes of the asset. Another of the immediate challenges today involves FAA regulations against flying a drone beyond line of sight of an operator. Gradually, the FAA is loosening some of these restrictions and waivers are being granted within specified conditions.

- Camera technology - As of 2023, multispectral cameras are suitable for drone mounting, having portability and capability to capture images from a moving camera at focal distances of a few meters. With today’s technology, imagery can be stored on the machine itself or transmitted wirelessly during capture.

- Data processing and anomaly detection – As of 2023, with sufficient training data, machine learning has been demonstrated to be effective at detecting anomalies in imagery.

- Use case: Asset Inspections by Multispectral Imagery – Combining technologies into an asset inspection use case is the next step. More needs to be known about the efficacy of the data gathered, the ability to retrieve actionable information, number of false positives and missed positives, and costs of the effort.

The following list of manufacturers is the product of an Internet search using a general description of the technology as the search term. Sometimes more than one variation on the search term is used. The objective is to identify the most demonstration-ready products available in the category. Toward assessing demonstration readiness, the manufacturer websites typically provide useful information such as writeups of successful use cases or field demonstrations, number of deployments, or other indicators. Where lack of information exists online, further inquiry is made by phone. Generally, one to three frontrunners emerge as being most ready for a field demonstration. Preference is given to manufacturers who sell to the United States, or, if emerging technology, those who have participated in US-based field demonstrations.

Implementations/Deployments

While the technologies involved in carrying out the use case are commonly used today, combining them effectively into an asset inspection use case is the next step. More needs to be known about the efficacy of the data gathered, the ability to retrieve actionable information, number of false positives and missed positives, and costs of the effort.

Innovations as of Mid 2023

.

Potential Enrichment Work Opportunity

References

[1] UNMANNED AIRCRAFT SYSTEMS (UAS): Advanced Payloads. EPRI, Palo Alto, CA: 2018. 3002015063.

[2] Weisenfeld, Neil et al. “Infrared Scanning Reveals Defects.” Tdworld.com. https://www.tdworld.com/underground- tampd/infrared-scanning-reveals-defects. (Accessed September 2018).

[3] Rebecca DelPapa Moreira Scafutto et al. “Evaluation of thermal infrared hyperspectral imagery for the detection of onshore methane plumes: Significance for hydrocarbon exploration and monitoring.” International Journal of Applied Earth Observation and Geoinformation 64 (2018) 311-325. https://www.sciencedirect.com/science/article/pii/S0303243417301411. (Accessed September 2018).

[4] Santovasi, Steve and Evans, Laron. “UAS Technology Offers Soaring Potential.” Burnsmcd.com.https://www.burnsmcd.com/insightsnews/tech/uas-technology-offers-soaring-potential. (Accessed September 2018).

2 - Environmental Monitoring

2.1 - Gas-Sensing Remote Smoke Detectors

Risk Reduction Category

Technology Description

Remote smoke sensors are based on similar proven technology as smoke detectors for the home but are specifically suited for forest application. Modern solid-state sensors are capable of detecting a wide range of Volatile Organic Compounds (VOCs) and gases [1], having many potential applications such as measuring air quality or detecting the presence and/or concentration of specific gases. Early wildfire warning is one potential application for these sensors, where the sensor output is monitored and interpreted by supporting electronics that will then send a positive detection message if the sensor output meets any of the defined profiles of smoke.

Technical challenges for use in the forest are twofold: lack of availability of a power source, and lack of an existing communications network. Further, the remotely installed equipment must be able withstand harsh outdoor environments.

Fortunately, the sensors and supporting electronics require very little power, allowing operation from a small solar panel and/or battery. Pioneers in remote smoke detection have overcome the communications obstacle by using a low bandwidth LoRaWAN mesh network. With sensors sending messages to local gateways, status information for the entire covered area is sent to a border gateway that connects to the Internet.

Technical Readiness (Commercial Availability)

The electronic sensors themselves are proven technology, however, the adaptation of that technology for detecting a smoldering fire in a rural forest is a relatively new concept. The following list of manufacturers is the product of an Internet search using a general description of the technology as the search term. Sometimes more than one variation on the search term is used. The objective is to identify the most demonstration-ready products available in the category. Toward assessing demonstration readiness, the manufacturer websites typically provide useful information such as writeups of successful use cases or field demonstrations, number of deployments, or other indicators. Where lack of information exists online, further inquiry is made by phone. Generally, one to three frontrunners emerge as being most ready for a field demonstration. Preference is given to manufacturers who sell to the United States, or, if emerging technology, those who have participated in US-based field demonstrations.

Implementations / Deployments

Dryad

- Launched in December 2022 [2].

- Fully commercialized and ready to scale [2].

- 50+ Proof-of-concept and pilot installations, each involving 20-400 sensors [2].

- Shipped 10,000 sensors worldwide [2].

- Deployments with CalFIRE (400 sensors) and PG&E [2].

- 40 worldwide resellers [2].

Torch

- Completed a number of short and longer-term tests at prescribed burning locations in California: mainly in Sonoma, Napa Valley, and Butte counties.

- Continuing to perform a wide range of testing on various burns and geographies to maximize accuracy.

- Now accepting pre-orders with availability in 2024.

Milesight

- No published materials found regarding field studies or pilot programs related to wildfire application of this product.

Libelium

- Website mentions 11 nodes deployed in a wildfire setting, but no outcome reported

- No published materials found regarding field studies or pilot programs related to wildfire application of this product.

Innovations as of Mid 2023

Potential Enrichment Work Opportunity

References

[1] Bosch Corporation. “BME860 Lower Power Gas, Pressure, Temperature & Humidity Sensor.” Document Number: BST-BME680-DS001-08 Revision_1.8_082022.

[2] Brinkschulte, Carsten. “Re: Dryad Catch Up call” Received by Doni Nastasi, 2 Nov. 2023.

2.1.1 - Dryad

Designed to detect smoke in the smoldering stage, Dryad sensors are built in the form of a hanging tag and mount directly to the trunk of a tree. They detect hydrogen, carbon monoxide, and other gases. In addition, they measure temperature, humidity and barometric pressure. They are powered by an integrated solar panel with supercapacitor storage. Multiple units communicate to a gateway using LoRaWAN for low bandwidth long-range communications. Multiple local gateways connect over a mesh network and to Internet through a gateway.

2.1.2 - Torch

Torch sensors detects smoke via camera (visible), infrared (thermal), and air chemical (smoke) detection. They are powered by an integrated solar panel and rechargeable battery, lasting up to 5 days without solar recharge. They communicate over a mesh network with hundreds of units communicating through one Internet connection. Coverage is one tree-mounted unit per ten acres according to the website.

2.1.3 - Milesight

Model EM500-CO2 is a multi-application indoor/outdoor device. It measures CO2, temperature, humidity, and barometric pressure. It operates from a non-rechargeable battery for up to 10 years. It communicates over a LoRaWAN to a gateway where it connects to the Internet. The update rate is between 2 minutes and 30 minutes.

2.1.4 - Libelium

Libelium manufactures an array of environmental sensing products and communication gateways. Wildfire detection is one of the possible use cases for their sensor and cloud platform. Their outdoor sensors are powered from solar panels and rechargeable batteries. Their communication technology includes LoRaWAN, Bluetooth, Wi-Fi, 868 MHz radio and others.

2.1.5 - Hayden Data Systems

Multi-awareness sensors on a mesh network and paired with custom awareness software platform.

2.2 - LiDAR - Light Detection and Ranging

Risk Reduction Category

Computer vision and situational awareness

Technology Description

LiDAR is data collection technology by which pulsed laser light is used to measure distances to surrounding objects. This data can be used to create visual maps or images of an area in which a LiDAR sensor has passed though. This data can be used to create three dimensional images with very precise detail. There are some limitations to data collection with regards to surfaces that diffract the laser pulses from returning to the LiDAR sensor; examples are water or wet asphalt.

LiDAR technology has been around for several years and has been used in many different applications. Some examples of applications are in automobiles for their autonomous driving ability, robotic platforms for autonomous navigation, and even in airport baggage handling conveyors tracking luggage. The data can be used to create 3D images of a wide area. Because the system uses a laser for measurement of the distance to nearby objects, the data can very accurately represent the dimensions of objects. Many models and manufacturers of LiDAR sensors are now commercially available, some purpose-built for specific applications, most of which are mobile mapping applications. The technology ranges from small and inexpensive enough to be used in hobby projects, to commercial and industrial grades producing higher resolution output at greater distances.

The LiDAR sensor produces what is known as a “point cloud” of data. Processing the point cloud into a visual rendering is a fairly intensive computing process. This is an area that is continually growing and improving. Further, any use-case-specific analysis such as those involving distance tolerances, is applied during post processing. For example, in the LiDAR image (right side of above image), objects are colored yellow or red to indicate encroachment in the utility right of way beyond specified limits.

Use Case Description

The advances in this technology when paired with a Unmanned Aerial System (UAS) allows it to be used to locate encroachment of vegetation near Utility Right of Ways and Infrastructure. It can also be used to identify dead trees that are near power lines, especially those that are already in the process of leaning towards power lines. Data files from LiDAR surveys can be saved and referenced against future surveys to determine the growth of vegetation for maintenance scheduling purposes. Surveys post-storm events can be used to help with tasking for problem areas to maximize restoration crews’ time.

EPRI recently conducted a project where a LiDAR sensor was mounted to a UAS as part of a demonstration project. The focus of this project looked at the use of a UAS mounted LiDAR system to help survey vegetation along a power line right of way. The project focused on the accuracy of the sensor data collected against a reference image.[2]

Some researchers are already looking at using the scanning properties of LiDAR to help establish algorithms by which LiDAR scans can be used to help locate smoke plumes as part of early warning of fires.[3]

Another group of researchers is compiling data sets of forest canopy to help identify areas of potential vulnerability.[4] More efficient data collections yield more frequent and up-to-date information that can be used in conjunction with fire risk modeling.

VeriDaaS has worked on an enhanced LiDAR detection system that allows LiDAR to better detect under canopy levels of foliage.[5] This technology detects potential fuel on the ground, improving situational awareness and prioritizing areas of highest risk for fire ignition and spread.

Technical Readiness (Commercial Availability)

LiDAR sensor technology was developed in the early 1960’s. It first uses were for mapping of the surface of the moon during NASA’s moon explorations and then to study weather phenomena such as clouds, smog, and pollen. This is a very mature technology that continues to improve with increases in semiconductor technology and software development for post processing of data for visualization.

The following list of manufacturers is the product of an Internet search using a general description of the technology as the search term. Sometimes more than one variation on the search term is used. The objective is to identify the most demonstration-ready products available in the category. Toward assessing demonstration readiness, the manufacturer websites typically provide useful information such as writeups of successful use cases or field demonstrations, number of deployments, or other indicators. Where lack of information exists online, further inquiry is made by phone. Generally, one to three frontrunners emerge as being most ready for a field demonstration. Preference is given to manufacturers who sell to the United States, or, if emerging technology, those who have participated in US-based field demonstrations.

LiDAR USA

Unmanned Systems Technology

https://www.unmannedsystemstechnology.com/expo/drone-lidar/

Phoenix LiDAR Systems

Microdrones

https://www.microdrones.com/en/

Implementations / Deployments

Innovations as of Mid 2023

Potential Enrichment Work Opportunity

References

[1] https://www.fabbaloo.com/news/can-apples-lidar-system-be-used-for-3d-scanning

[2] 3002016591_Unmanned Aircraft System Based LiDAR versus Photogrammetry A Critical Comparison for Vegetation, 2019, Electric Power Research Institute

[3] https://www.firelab.org/resource/lidar

[4] https://www.mdpi.com/2072-4292/12/6/1000

[5] https://veridaas.com/2022/08/remotely-sensed-lidar-data-supports-wildfire-management/

2.3 - Micro Weather Stations

Risk Reduction Category

Technology Description

Conditions on the ground before a wildfire event—wind direction, speed, temperature, humidity—can provide clues about the conditions leading to development of the wildfire, conditions that may help predict the likelihood of a fire developing in a particular area so that preventive measures may occur. Likewise, monitored ground conditions can help in controlling prescribed burns intended to pre-empt wildfires.

Remote, local ground conditions may be communicated through the placement of “micro” weather stations within areas prone to wildfires as well as in nearby residential areas needing protection from those wildfires. Various sensors are available to measure air and/or water temperatures, humidity, soil temperatures, soil dampness, leaf wetness, perhaps several at once. Some of these stations and sensors may be somewhat expensive. One IEEE publication described a model developed by yet another reference—using soil moisture and temperature data obtained through remote sensing—for predicting the extent of wildfires.[6] [7]

One company, Onset, supplies dataloggers, and field sensors it has developed for such purposes. Historically, it developed relatively inexpensive, battery-operated devices—such as the HOBO. The HOBO® Weather Station may be set to collect readings on the hour or half-hour for weather parameters. The collected fire weather data may be used as inputs to fire modeling software such as FSpro (a predictive model that looks at the probability of the spread of fire). [1]

Intellisense Systems developed its Fire Weather Observation System (FWOS)—weighing 5 pounds and quickly deployable in sixty seconds or less. Fire weather-related data, including solar radiation, fuel moisture, particulate monitoring, and thermal imaging data may be transmitted wirelessly through cell-phone coverage or via satellite. They also provide software, Quantimet®, for handling the data. [2]

Advanced Engine Management (AEM), an organization producing monitoring systems for a wide variety of potentially disastrous situations (dam safety, flood risk, severe weather risk, etc.) owns Forest Technology Systems (FTS) which focuses on wildfire risks (monitoring and detection). Services and products include remote, automated weather stations (RAWS), wildfire PTZ cameras, quick deploy RAWS, and software integrating all sensors—the FTS360. A one-hour webinar (free) details their system and its use. [5]

Technical Readiness (Commercial Availability)

The following list of manufacturers is the product of an Internet search using a general description of the technology as the search term. Sometimes more than one variation on the search term is used. The objective is to identify the most demonstration-ready products available in the category. Toward assessing demonstration readiness, the manufacturer websites typically provide useful information such as writeups of successful use cases or field demonstrations, number of deployments, or other indicators. Where lack of information exists online, further inquiry is made by phone. Generally, one to three frontrunners emerge as being most ready for a field demonstration. Preference is given to manufacturers who sell to the United States, or, if emerging technology, those who have participated in US-based field demonstrations.

Advanced Engine Management/ Forest Technology Systems AEM/FTS

Implementations / Deployments

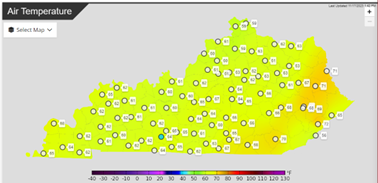

Southern California Edison (SCE) has an interactive Weather and Fire Detection Map system indicating areas under fire weather watch, red flag warning, wind advisory, high wind watch, and high wind warning. Such areas are indicated on an accompanying map. Power safety power shutoff (PSPS) action information is also provided. They may have helpful information concerning the sensors used in their system.[3] The map is powered by software from Environmental Systems Research Institute, Inc. (Esri) [4]

Innovations as of Mid 2023

Potential Enrichment Work Opportunity

References

[1] https://www.onsetcomp.com/resources/application-stories/weather-station-aids-wildfire-management

[2]https://www.intellisenseinc.com/news-events/news/fire-weather-observation-system-from-intellisense-helps-combat-wildfires-in-yosemite-national-park/

[3] https://www.sce.com/wildfire/situational-awareness

[4] https://www.esri.com/en-us/home

[5] https://aem.eco/solution/wildfire-risk-management/

[6] Three Lines of Defense for Wildfire Risk Management in Electric Power Grids: A Review, Ali Arab, et al., IEEEAccess, 4/28/2021.

[7] D. Chaparro, M. Vall-llossera, M. Piles, A. Camps, C. Rüdiger, and R. Riera-Tatche, ‘‘Predicting the extent of wildfires using remotely sensed soil moisture and temperature trends,’’ IEEE J. Sel. Topics Appl. Earth Observ. Remote Sens., vol. 9, no. 6, pp. 2818–2829, Jun. 2016.

2.4 - Vegetation Condition Assesssment by Multispectral Imagery

Risk Reduction Category

Technology Description

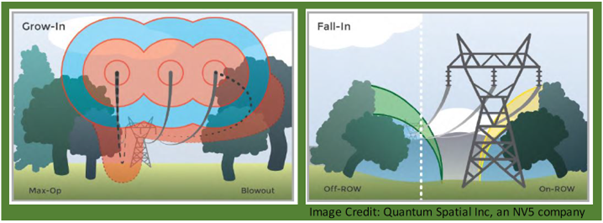

Vegetation threat analysis refers to identifying vegetation that may encroach upon powerlines, transformers, and support structures. Depending on line voltage, elevation, and local concerns, vegetation clearance requirements may range from as little as 1 foot (0.3 m) for a low-voltage conductor to 13 feet (3.0 m) for a high-voltage line at high elevation [7]. Vegetation should be considered when it grows towards utility assets (e.g. grow-in threat), and when the vegetation extends above assets and could fall on a conductor or other component (e.g. fall-in threat).[6] Trees stressed by drought leads to additional risk of premature falling into power lines. Additionally, areas impacted by drought may have increased amounts of dry biomass ‘fuel’ underneath the tree canopy.

Utility rights of way are often inspected manually. Even with the aid of helicopter or fixed wing aircraft, any imagery that is collected during the inspection is analyzed post-flight by humans. Further, utilities routinely dispatch arborists to manually inspect trees on a watch list or to place additional trees on the watch list – a time consuming and costly exercise.

Because utility Vegetation Management (VM) programs are one of the largest recurring maintenance expenses for electric utility companies in North America [5], it is important to identify ways of reducing these costs. Technology improvements including automated UAS, multispectral imagery, and image processing offer new opportunities for utilities to improve the efficiency and accuracy of their vegetation inspections. Multispectral cameras can extend the information gathered during aerial inspections, capturing information that is otherwise indetectable with standard visual (RGB) cameras. Most multi-spectral cameras capture RGB imagery along with imagery in both the infrared and ultraviolet wavelengths. The extended bands can be captured at the same frame rates and resolutions as their visual counterparts, providing layers of imagery that can be analyzed by humans or AI.

- Visual (RGB) – captures bands detectable with the human eye (red, blue, and green)

- Infrared (IR)– detects heat signatures. This band is ideally suited for vegetation condition because chlorophyll, an indicator of healthy vegetation, reflects in the IR band.

- Ultraviolet (UV)– can reveal arcing, partial discharge, and flame. While perhaps not the primary focus for vegetation inspection, this band can detect arcing caused by overgrown vegetation. Because it is included in the data being gathered, it can be simply another layer of intelligence gathered on the ROW.

What is envisioned is a periodically self-deploying UAS, located in a sheltered charging station, that would fly a programmed (or self-guided) route along utility rights of way. Imagery collected by the UAS could be uploaded to a cloud service or processed locally. Machine learning would analyze the imagery, detect conditions of interest, and send alerts upon detection of these anomalies. This same equipment can be dispatched for various other purposes such as asset inspections, fault location, or even suspected fire ignitions.

Technical Readiness (Commercial Availability)

The vision for the future of aerial vegetation inspections involves a complex combination of state-of-the-art technologies:

- Automated UAS flight - As of 2023, most UAS deployed by utilities are manually operated, however, as technology improves automation is increasingly possible. A challenge with automated aerial asset inspections has to do with the ability to capture useful imagery [1]. Lighting, truncation, and obscuring of the subject can be factors. This challenge is being addressed by improvements in navigation technology. Another of the immediate challenges today involves FAA regulations against flying a drone beyond line of sight of an operator. Gradually, the FAA is loosening some of these restrictions and waivers are being granted within specified conditions.

- Camera technology - As of 2023, multispectral cameras are suitable for drone mounting, having portability and capability to capture images from a moving camera at focal distances of a few meters. Multispectral cameras are ideally suited and commonly used for vegetation health assessment in a variety of ecological use cases. Purpose-built RedEdge cameras focus more narrowly and specifically on the band centered on the wavelength reflected by chlorophyll.

- Data processing and anomaly detection – As of 2023, with sufficient training data, machine learning has been demonstrated to be effective at detecting anomalies in imagery. Vegetation assessment may involve detecting trees that are leaning or fallen (detectable with RGB bands) and assessment of health of vegetation (detectable with the infrared band).

Combining these technologies into a vegetation inspection use case is the next step toward the vision of fully automated vegetation inspections. More needs to be known about the efficacy of the data gathered, the ability to retrieve actionable information, number of false positives and missed positives, and costs of the effort.

The following list of manufacturers is the product of an Internet search using a general description of the technology as the search term. Sometimes more than one variation on the search term is used. The objective is to identify the most demonstration-ready products available in the category. Toward assessing demonstration readiness, the manufacturer websites typically provide useful information such as writeups of successful use cases or field demonstrations, number of deployments, or other indicators. Where lack of information exists online, further inquiry is made by phone. Generally, one to three frontrunners emerge as being most ready for a field demonstration. Preference is given to manufacturers who sell to the United States, or, if emerging technology, those who have participated in US-based field demonstrations.

Implementations / Deployments

While the technologies involved in carrying out the use case are commonly used today, combining them effectively into a vegetation condition use case is the next step. More needs to be known about the efficacy of the data gathered, the ability to retrieve actionable information, number of false positives and missed positives, and costs of the effort.

Innovations as of Mid 2023

Potential Enrichment Work Opportunity

References

[1] UNMANNED AIRCRAFT SYSTEMS (UAS): Advanced Payloads. EPRI, Palo Alto, CA: 2018. 3002015063.

[2] Weisenfeld, Neil et al. “Infrared Scanning Reveals Defects.” Tdworld.com. https://www.tdworld.com/underground- tampd/infrared-scanning-reveals-defects. (Accessed September 2018).

[3] Rebecca DelPapa Moreira Scafutto et al. “Evaluation of thermal infrared hyperspectral imagery for the detection of onshore methane plumes: Significance for hydrocarbon exploration and monitoring.” International Journal of Applied Earth Observation and Geoinformation 64 (2018) 311-325. https://www.sciencedirect.com/science/article/pii/S0303243417301411. (Accessed September 2018).

[4] Santovasi, Steve and Evans, Laron. “UAS Technology Offers Soaring Potential.” Burnsmcd.com. https://www.burnsmcd.com/insightsnews/tech/uas-technology-offers-soaring-potential. (Accessed September 2018).

[5] Federal Energy Regulatory Commission. “Tree Trimming & Vegetation Management.” Federal Energy Regulatory Commission. https://www.ferc.gov/industries/electric/indus-act/reliability/vegetation-mgt.asp.

[6] Maximizing the Value of Right-of-Way (ROW) Unmanned Aircraft Systems (UAS) Collected Data: Four Applications for Remotely Sensed Data. EPRI, Palo Alto, CA: 2020. 3002018898.

[7] Vegetation Indexes for Hazard Tree Management. EPRI. Palo Alto, CA. May 2020. 3002017448. https://www.epri.com/research/programs/025032/results/3002017448

2.5 - Smoke Detection Cameras

Risk Reduction Category

Technology Description

The technology consists of a network of long-range, geo-located cameras that are mounted to existing or dedicated structures and are coupled with image processing and AI to alert on early detection of smoke. This technology has been field-proven to alert fire responders before receiving the first 911 call. Rapid confirmation of fire, size approximation, and geolocation are additional benefits of the technology compared to eyewitness reports via 911.

While many of such cameras are mounted to existing mountaintop towers, having long range views, others are designed for more remote locations where power supply and communications may be scarce. Additionally, some manufacturers couple their visual cameras with other detection means such as infrared sensing and chemical (smoke) detection.

Technical Readiness (Commercial Availability)

A few vendors are currently supplying equipment and/or software commercially with small-scale deployments. Two broad categories of vendors exist in this space: first, those who supply turnkey systems – both hardware and software, consisting of purpose-built camera/sensor systems, paired with software including an AI engine, visualization, alerting system, and web portal. A second category of vendors provides the software components only, utilizing a camera-agnostic platform that can accept any standard source of video. These vendor platforms can utilize, for example, publicly available imagery from California’s network of ALERT Wildfire cameras.

Leaders in early fire detection can support the intake of additional data such as temperature, humidity, wind speed, etc. to improve the AI and to predict severity and spread of fire.

The figure below shows a typical view from a fixed, tower-mounted camera. If desired, panoramic views can be provided by an array of fixed cameras or by motorized PTZ (pan, tilt, zoom) cameras. Image processing and AI discern smoke from fog and clouds. Although the view is long range, the typical distance for accurate detection of small fires, measuring 3’ x 3’, is about 300 yards. With increasing distance, the fire must be larger to be detected. Accuracy of detection is expressed in terms of false positives and false negatives. These systems can detect smoke or flame during daylight hours and flame during periods of low light. AI analyzes the image for smoke and produces bounding rectangles (simulated in the figure below) indicating a positive detection.

Related Technology

Vendors with Hardware and Software

Pano https://www.pano.ai/

Delphire, Inc. https://delphiretech.com/ www.wildfireai.com viewing portal (experimental)

Delphire offers a multi-sensor platform with built-in infrared detection, chemical smoke sensor. Additionally, external inputs, such as wireless soil moisture sensors, can be connected via Wi-Fi. Delphire also performs edge computing on the unit, reducing the communications requirements. Low power requirements allow it to operate from a solar panel and battery.

IQ FireWatch (Germany) https://www.iq-firewatch.com/

SmokeD

www.smokedSystem.com

Vendors with Software Only

FireScout - uses ALERT Wildfire camera network https://firescout.ai/

Chooch https://www.chooch.com/solutions/wildfire-detection/

Exci www.exci.ai

Implementations / Deployments

Pano: 33 cameras in CA, approximately 100 total (TechCrunch July 2023) [1]

Delphire: approximately 10 cameras installed during various pilots and grant-funded installations. [2], [3], [4]. Commercially available with production capability of approximately 30 units per month (phone interview with Gilberto DeSalvo 1/29/24).

SmokeD, a Polish company, has deployed cameras in Austin, TX and in California.

ALERT Wildfire

https://www.alertwildfire.org/

Publicly available imagery from approximately 175 cameras online as of 9/5/2023 across parts of California, Nevada, Oregon, and reaching into Arizona, Colorado, Washington, and Montana (see map below).

ALERT California

Originally part of ALERT Wildfire, but became a state-specific program focused on covering California. Publicly available imagery from a network of 1000+ “cameras and sensor arrays” including partner equipment such as Caltrans traffic cameras.

High Performance Wireless Research and Education Network (HPWREN)

Approximately 280 cameras reporting publicly available imagery as of 9/5/2023 with locations in southern California (see locations below). Update rate is approximately one frame per minute. Some older cameras are monochrome and fixed. Newer cameras are full color and PTZ. Archived data accessible.

Innovations as of Mid 2023

- AI layers filter out false positives like clouds and fog

- AI obfuscates private residences, humans and other non-public imagery

- Real time imagery is viewable via web portal

- Flexible Machine Learning platform that can add physical security (people detection), for example

Potential Enrichment Work Opportunity

Added data layers and data fusion such as: Wind, Weather, Vegetation Condition, Power Line Proximity to a Fire, Emergency Response Agent Locations, etc.

References

2.6 - Synthetic Aperture Radar (SAR) from Satellite Imagery

Risk Reduction Category

Computer vision and situational awareness

Technology Description

Data from Synthetic Aperture Radar (SAR) is captured by equipment mounted on low earth orbiting satellites. Normally, satellites orbit in a North-South direction and view a swath of some width as they travel. The width and the spatial resolution are dictated by the purpose and requirements of the collection.

SAR operates on the fundamental radar principle, by emitting energy and sensing the energy being reflected by the subject. Synthetic aperture refers to the technique by which very high resolution can be achieved by propelling the transmitter and receiver over a distance while focusing on the subject. For the wavelengths needed to achieve high resolution of around 10 m, an impractically long antenna, on the order of 2.5 miles long, would normally be required. However, a similar result can be achieved by taking multiple captures over that distance with a much smaller antenna.

Satellite imagery of a right-of-way (left: optical image, right: processed SAR image) [1]

SAR does not require visible light, as it provides the radiating energy source. It can therefore be used day or night and is unincumbered by clouds and smoke. Properties of the energy being emitted, such as the wavelength and polarization, can be optimized for desired results; for example, reflecting from the surface of a tree canopy versus penetrating deeper into the tree canopy.

Use Case Description

Attaining a comprehensive overview of damage severity across a wide area immediately after severe weather is a challenging task. Typically, the storm danger must pass, and daylight is essential before assessors can safely identify damage extent and location of access-obstacles. The damage assessment process is also very labor intensive, at times requiring days to gain full visibility of damage from severe winds, hurricanes, or tornadoes. Synthetic aperture radar may offer an improved approach to damage assessment. Current satellite technology provides the availability to acquire a SAR image four times per day or once every six hours, and this frequency may improve as more SAR enabled satellites are launched. Because these are radar images, cloud cover and night-time visibility are non-factors in the image acquisition. [1]

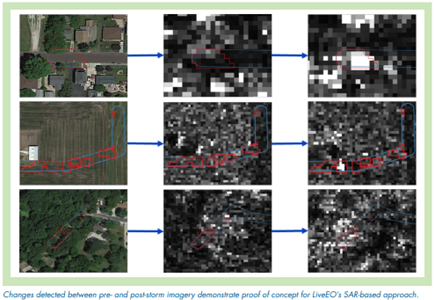

SAR is a good tool for showing changes over time. With pre- and post-storm imagery, change detection algorithms could determine where vegetation and structures are no longer present in their original location or appear to have fallen. By comparing the downed trees to the geospatial locations of the lines and structures, the vegetation damage may provide early insights into likely locations of power system damage. The approach may effectively project storm damage locations and severity before damage assessors can safely get out to start their work.

Technical Readiness (Commercial Availability)

SAR has existed for at least 10 years and is currently being collected via satellite routinely for public and private use. Both historical collections and ongoing collections are available to the public at the following URL, which is an opportunity for an introductory glimpse at example SAR data for those unfamiliar with the topic: https://search.earthdata.nasa.gov/search?q=SAR

With 2022 era availabilty, each opportunity to acquire a SAR image by satellite can happen as frequently as four times per day or once every six hours. Data availability is expected to improve as more SAR-enabled satellites are launched. The storm use case would require working with a vendor to acquire imagery on specific dates of precisely the area of interest and with high spatial resolution. In many cases, two vendors will be required, as the satellite vendor is concerned with positioning and data capture, whereas the processing of SAR data is another specialty.

For best results, the use case ideally would include three collections in same area immediately before the storm and in dry conditions (rain on leaves can interfere with wave refraction). Another consideration is the orientation of orbit: ascending pass versus descending pass. For better performance of the image comparison, all data would ideally be captured in the same direction of orbit.

SAR Data Providers

-

Capella Space (USA)

Commercial satellites producing SAR data. Analytics partners provide change detection solutions.

-

ICEYE (Finland)

Commercial satellites for purchase, lease, or for data collections.

-

LiveEO (Germany)

SAR image processor with focus on infrastructure such as railways, electric power grid, and pipelines.

Implementations / Deployments

In 2021, EPRI, Ameren, and Fortis BC sponsored a proof-of-concept field demonstration with SAR provider LiveEO [2]. Objectives of the study were focused on feasibility of using the proven technology for the unique application of storm damage assessment. Specifically, the team was interested in the following aspects:

- the time required to task satellites and capture imagery,

- the time required to process and analyze SAR imagery,

- the resolution and accuracy of the imagery, and

- the effectiveness of AI-based algorithms to assess storm damage.

LiveEO analyzed pre- and post-storm imagery and detected a number of plausible changes in conditions that can be attributed to fallen trees and other damage. Results were provided to Ameren within 17 hours of post-storm imagery acquisition, demonstrating the feasibility of adequate turnaround in producing actionable information relating to storm damage even with the existing constellations of satellites in orbit. Some challenges were identified during the field trial, the details of which are publicly available. [2]

Innovations as of Mid 2023

Potential Enrichment Work Opportunity

References

[1] Assessment of Satellite Derived Radar Imagery for Initial Storm Damage Assessment. EPRI, Palo Alto, CA: 2023. 3002026273.

3 - Fault Count and Frequency Reduction

3.1 - Covered Overhead Conductors

Risk Reduction Category

Technology Description

Utilities with heavy tree cover have greater exposure not only to contact with trees, but also increased contact with squirrels and other wildlife. Even when the electrical system is resilient against these external forces, utilities are affected negatively in terms of perceived power quality and performance metrics such as the annual count and duration of interruptions. Additionally, every fault creates another risk of fire ignition due to arcing near vegetation. One potential remediation is a covered conductor system that can prevent a number of these more common faults.